Julian,

I sent my ZF for overhaul by RBT and the process was fairly simple, although the Canadian Government doesn't make it easy to find that out. Essentially you should export your parts temporarily. This proves that they were here in the first place.

First step in the process is to stop at Canadian Customs BEFORE you leave Canada. The CBSA guys will (when you are exporting them) inspect the parts (maybe) and stamp your completed E15 (see below) form (insist on that). Then, upon re-importation, you should have the form and your repair invoice showing the work that was done. Taxes will be based on the actual value (in $ CDN) of the work done. No duty is applicable as it will be done in the USA.

I like to be UBER prepared and have photo documentation (before/after), proof of payment, contact information for the restorer etc. Basically, if CBSA wants to make your life difficult then be prepared to make their job easy and they will see that you're doing things properly.

Here is a link to the relevant guideline:

http://www.cbsa-asfc.gc.ca/pub.../d8/d8-2-11-eng.html

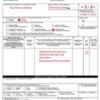

And an image of the E-15 form (see page 11 or so of THIS link: http://www.cbsa-asfc.gc.ca/pub.../d20/d20-1-4-eng.pdf )

Good luck. Feel free to email me directly if you have any questions.

Mark

PANTERA INTERNATIONAL

A DE TOMASO CAR CLUB

Presents the De Tomaso Forums

The On-Line Meeting Place for De Tomaso Owners and Enthusiasts From Around the World

Clicking on the banner will take you to the sponsor's website.